- #Bench bookkeeping excel password how to#

- #Bench bookkeeping excel password software#

- #Bench bookkeeping excel password free#

Most comprehensive DIY software: QuickBooks.

#Bench bookkeeping excel password software#

Here are the top eight bookkeeping and accounting software options to look into for your small business. The best bookkeeping software for small businesses But with so many options to choose from, how can you know which one is best for your business? We’ve compiled a list of the best bookkeeping software to help you decide. Then, sign up for Bench, and we’ll automatically track every business expense, no matter who paid for it.Īnd remember, when your expenses are tracked, you’re on the road to good bookkeeping and mastering your small business finances.This is where software can save the day, cutting down on time spent on data entry and reducing errors that could negatively impact your financial health. If it’s for a business partnership, make sure each partner has a dedicated credit card just for business.A joint spreadsheet can do the trick just fine.If you’re trying to track spending with your spouse or business partner, we have a few suggestions:

#Bench bookkeeping excel password how to#

Stumped on how to categorize your expenses, or why you need to do it? Get in the know with our simple guide on how to categorize business transactions. Set time aside each week in your workflow to review them and apply categories to each one. Regularly review and categorize your business expensesĮxpense tracking tools take a big load off your shoulders, but it’s still important to keep tabs on your expenses. Check out our top picks for the best small business credit cards. If you charge your expenses on credit, there are even more benefits to using a business credit card-like building business credit and earning rewards. A business bank account makes keeping tabs on business transactions a breeze. In any case, it’s best practice to separate your personal and business income and expenses. In some cases, you may be legally required to have separate accounts to protect yourself from liability incurred by the business.įurther reading: Do I need a business bank account? Separating your business and personal spending makes identifying business expenses simple and fast. Separate your personal and business transactions Better yet, we’ve compiled a list of the best receipt apps for small businesses.įurther reading: How long to keep business tax records and receipts 2. You may be able to store these files in your expense tracking app, or if you take the Excel route, keep them on your computer and back up your files on a regular basis. Double-check the images are clear and capture the entire receipt. The first step is to scan or take photos of your receipts. So how do you tackle that pile of crumpled receipts you’ve collected from your car, purse, pockets, and dining room table? Once you’ve chosen the expense tracker that best suits your needs, you’re ready to get cracking.

#Bench bookkeeping excel password free#

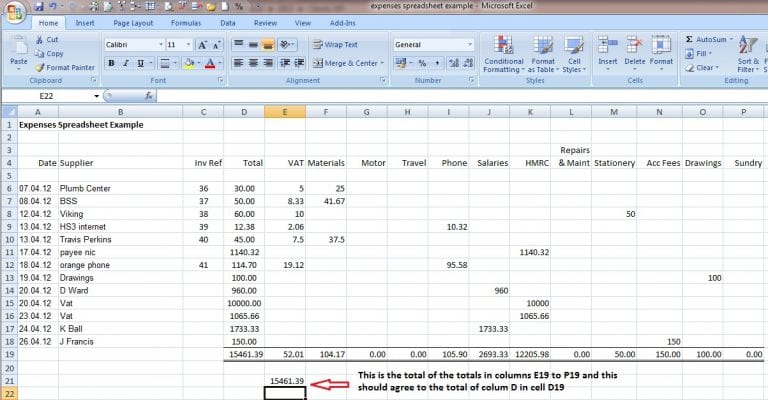

Price: Free (comes installed on most computers) What is the best way to track business expenses? For example, if you use the Bench Income Statement template, your transactions will turn into a handy income statement sheet, showing your profit and loss over a certain period. The great thing about Excel is, once you’ve entered all your transactions, you can generate reports and start getting insights about what those numbers mean. Just find a good Excel bookkeeping template and enter all your expenses at least once a week. Price: Starts at $4.99/month Bench: For hands-off expense tracking and bookkeepingĮxcel spreadsheets are the tried-and-true method of tracking your expenses (for free). But it can function as a great reimbursement app for your employees’ expenses.

Heads up: Expensify is not a balance tracker, unlike the other options in this list. If all you’re looking for is an app to scan, upload, and store receipts, these two are great options. Worthy expense tracker app alternatives: Receipt Bank and Shoeboxed. Racking up the company card? Automate your workflow and import those expenses directly from your card, so you don’t have to go through your statements at the end of each trip.Įxtra convenient: Expensify automatically converts to any currency and offers integrations with most accounting software. Plus, Expensify also automatically imports receipts from Uber, Airbnb, and more. Snap pictures of your paper receipts with your mobile device, submit, and be done with them. Using Expensify means you can stop stuffing receipts into your luggage while you’re on the go. If you work remotely, or regularly have meetings in different parts of the country, you know post-trip expense tracking is a nightmare.

0 kommentar(er)

0 kommentar(er)